Are you scam aware?

Society’s growing reliance on technology is providing scammers with new opportunities to target Australians.

First, it was mail scams then telephone scams.

Nowadays the rise of digitalisation has provided scammers with an array of additional channels to execute their tactics.

The Australian Competition and Consumer Commission (ACCC) reported that Australians lost a record amount of more than $2 billion to scams in 2021, despite government, law enforcement, and the private sector disrupting more scam activity than ever before.

People aged 65 and over reported the highest losses, and reported losses steadily increased with age.

Understanding the types of scams, their delivery methods, and actions to take if you identify a potential scam are vital to become scam aware.

Scam types and delivery methods

Currently phone, email and via social media are the three most common communication methods used to deliver scams.

There are three scam categories to note

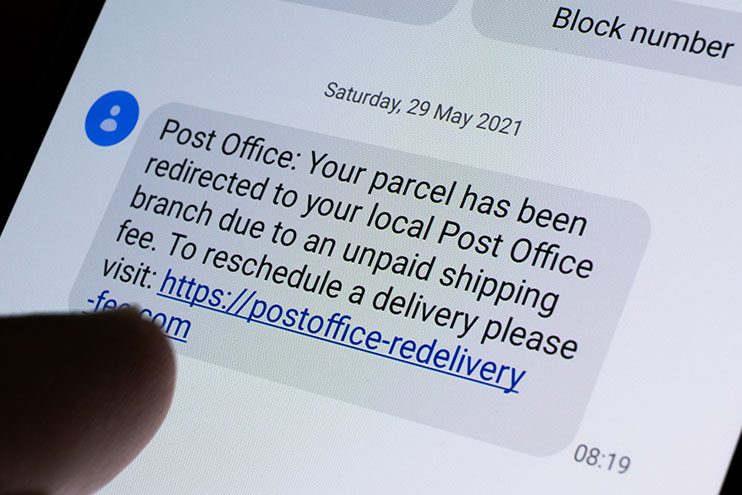

Phishing

Scammers attempt to trick you into providing personal information by pretending they are from a legitimate business.

Threat based

Scammers demand money that you supposedly owe, followed by threats if you do not cooperate.

Identity theft

Fraud that involves using someone else’s identity to steal money or gain other benefits.

Spotting scams

The ACCC advises there are some common tell-tale signs of a potential scam.

Be cautious if someone:

- You don’t know contacts you.

- You’ve never met requests money.

- Requests money through unusual payment methods, or requests sensitive information such as your bank details and passwords.

- Pressures you into buying something or making a decision quickly.

- Offers you something that appears too good to be true — such as a competition prize, or an unclaimed inheritance.

What if you’re not sure if it’s a scam?

If you are still unsure if the person you are speaking to is legitimate, SA Police recommends that you contact the company using the phone number or email address from the phone book or the business’s offcial website.

Importantly, before sharing bank details or transferring money, discuss it with a family member or friend. You can also visit scamwatch.com.au to check if you have been targeted by a known scam.

What to do if you think you have fallen victim

If you believe that you have been targeted by a scam, SA Police and the ACCC advises that you:

- Report a cybercrime, incident or vulnerability.

- Contact your bank if you have shared your financial information or sent money to a scammer.

- Change your online passwords if you have fallen victim to a computer scam.

- Reach out to your GP, local health professional or someone you trust if you feel overwhelmed and stressed.

Helpful resources

- Scamwatch.gov.au is the official Federal Government website for tips, advice, and scam news

- Cyber.gov.au/acsc/register where you can register for email alerts on recent online threats

The Scamwatch and ACCC websites contain a range of tools and resources about scams.

- Be Safe, Be Alert Online Information on organisations who may be able to help when someone has been scammed.

- Where else to get help Other organisations who might be able to help when someone has fallen victim to a scam.

- Little Black Book of Scams Information on identifying a scam (available digitally in a range of languages).

Would you like to become more tech-savvy?

ACH Group Expert Tech Coaching provides a 1:1 tuition to learn more about your computer, iPad or phone in a supportive environment.

Understand how technology can keep you in touch with your family and friends, and become confident about online shopping or booking appointments.

Contact us or call 1300 22 44 77.